The choice of the right UK options trading platform is among the most crucial aspects of the trading process for options. The broker you choose will determine what options you can trade and whether or not you are able to use binary options. A broker also decides whether an asset is suitable for trading options. It is essential to choose an agent that is licensed by the FCA. This will ensure your security as an investor in the UK.

There are many benefits when trading on the UK options platform. One of the benefits is a wider choice and higher security. The traders also benefit of many in-underlying assets. Many UK options trading platforms provide a wide variety of the underlying assets. This means you have more options when it comes to the method of trading.

trading platforms uk of a UK options account are a managed account with an agreed number of trade signals and secure trades each day. Plus all UK Options accounts include an ebook and email lessons to help you learn to trade Binary Options. In addition, UK Options provides an Islamic account, which is also called a no-riba account. This account allows Islamic customers to keep Binary Options positions indefinitely. In addition the company is aware of Hibah laws and makes it simple for Islamic traders to donate their profits to charitable organisations.

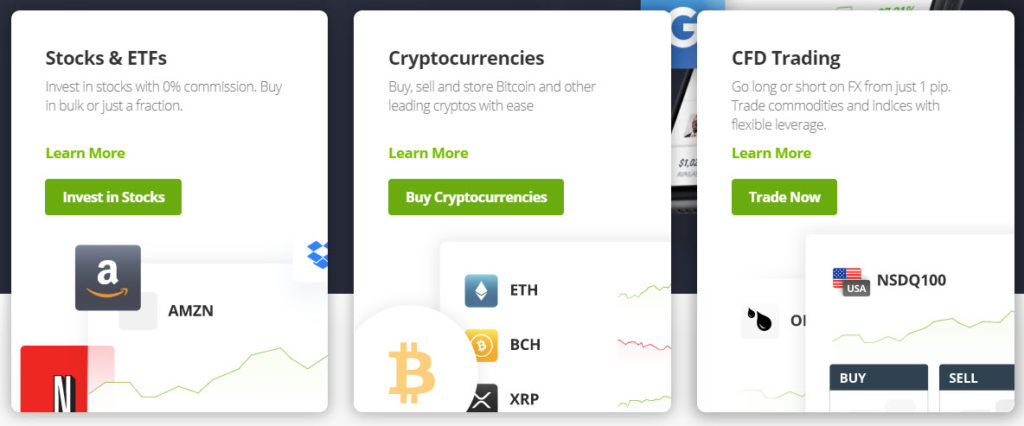

If you’re in search of an UK options trading platform first thing you should do is select a broker with a large variety of indexes. You can select among the many indices that are offered on the London Stock Exchange. You can also search for CFD options on indices.

XTB has low trading fees and is regulated by top jurisdictions. Spread bets are another option provided by the company. Plus, you don’t need an initial deposit. Only problem is that you will have to pay a commission for each trade you make. The company also has an exclusive platform called xStation that isn’t accessible to UK customers.

There are a variety of brokers in the UK. However there are many brokers that will not be equally good. You must choose which one best suits your needs in trading. For instance, AvaTrade is a good option if you live in the UK. They’re also a CFD licensed broker, which means you can receive an extra 20% to begin trading. They also provide a complimentary 21-day demo account to help to get started. However, you must be aware that the company isn’t accessible to US or New Zealand traders. You can also withdraw any profits with no restrictions, by depositing at least $100.

Another good option is Saxo Bank. Saxo Bank is an online platform that allows users to trade a variety of products through a single platform. This makes trading incredibly simple. Kim Fournais founded Saxo Bank in 1992. Saxo Bank is headquartered in Copenhagen, Denmark.